This Promising Trend Hints That Palantir Could Be a Great AI Stock to Buy Right Now | The Motley Fool

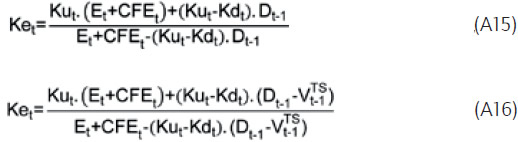

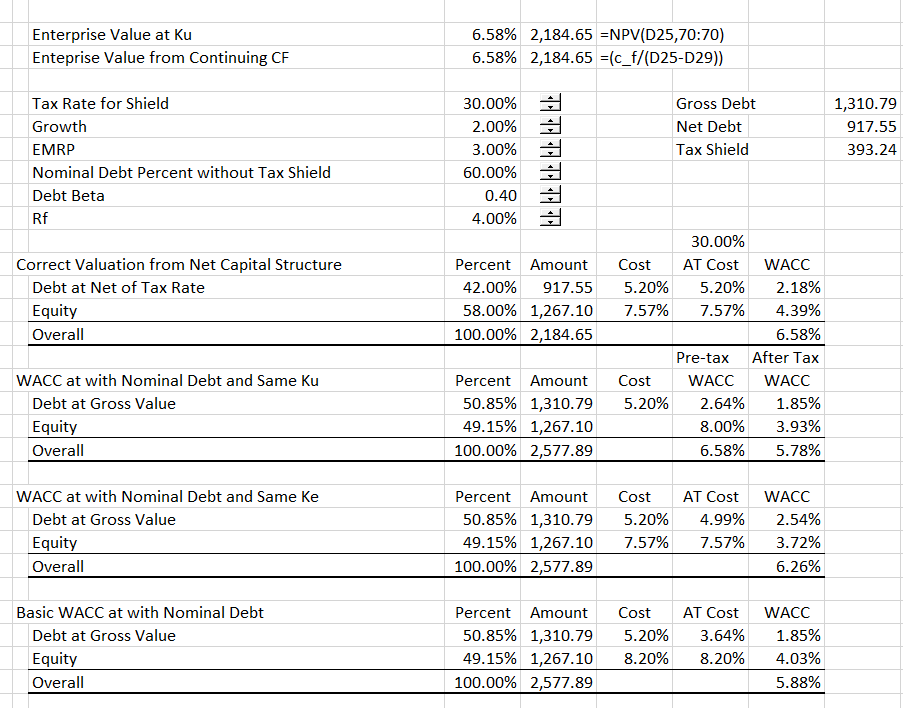

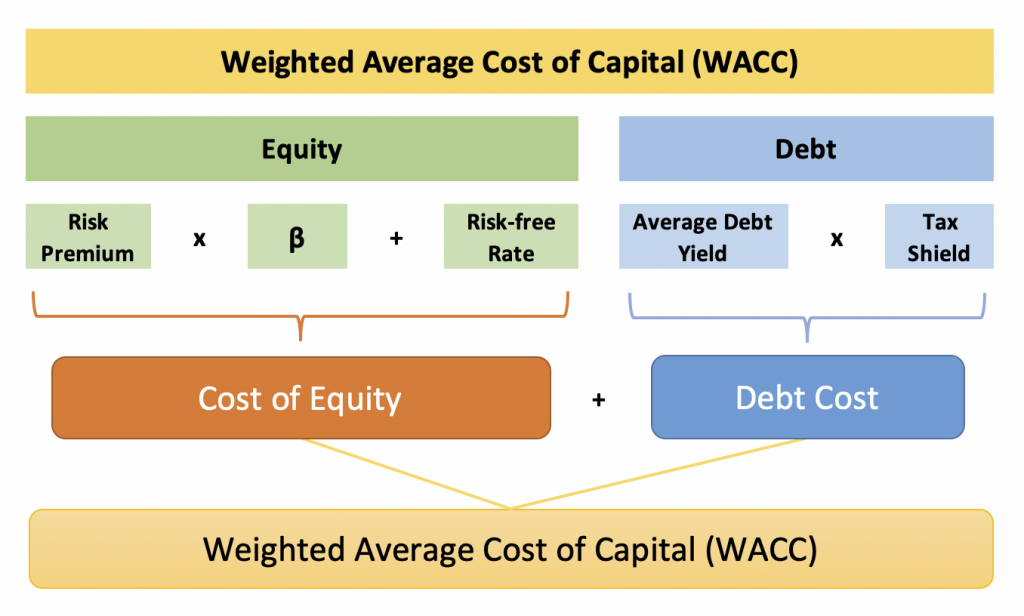

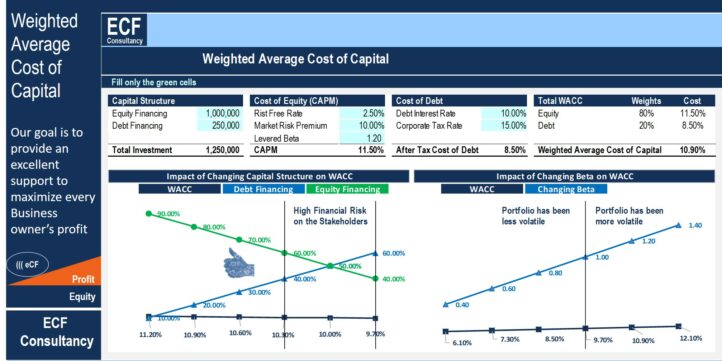

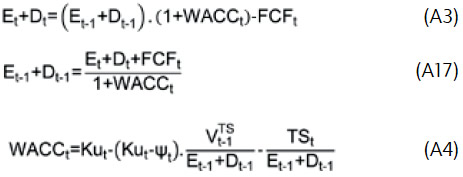

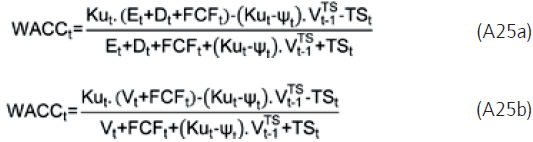

Vista de Analytical solution to the circularity problem in the discounted cash flow valuation framework | Innovar

Vista de Analytical solution to the circularity problem in the discounted cash flow valuation framework | Innovar

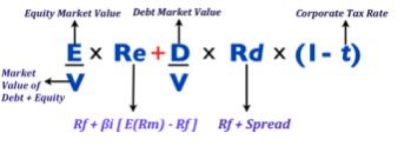

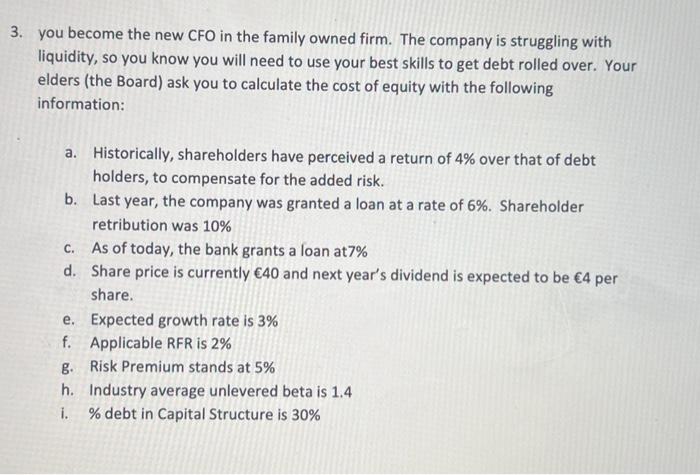

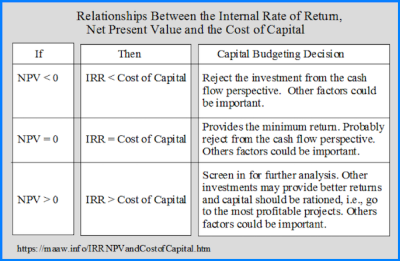

Rolling Corporation is constructing its Cost of Capital schedule. The firm is at its target capital structure. Its bonds have a 2.8 percent coupon, paid semiannually, a current maturity of 14 years,